Frequently Asked Questions

General Questions

- Can I make a deposit at a non-Notre Dame FCU ATM?

-

Yes, know that deposits made at non-Notre Dame FCU ATM’s can take up to 7 days to process. For quicker access to funds use the remote deposit capture feature in our mobile app.

- What is the routing number for Notre Dame Federal Credit Union?

-

The routing number is 271291596 and is located on the bottom left corner of your personal checks.

- Do you offer safe deposit boxes?

-

Yes, we offer safe deposit boxes. Please contact the branch to check for availability and size. We currently offer safe deposit boxes at the following branch locations:

Moreau: 574-400-4660

Portage: 574-400-4860

Edison: 574-400-4800

Granger: 574-400-4840

- When do transactions post to my account?

-

The below schedule is an estimated time frame of when transactions may occur in your account and not a guarantee of the time of transaction:

Transaction > Time of Day

ACH Electronic Deposits > Morning

Debit/Credit Card Transactions > Throughout the day

Wire Transfers > Throughout the day

ACH Electronic Withdrawals > Evening

Automatic Funds Transfers > Evening

Share Draft Checks > Evening

- What is the difference between actual balance and available balance?

-

Actual Balance is the amount of money that is in the account; for example in the image below the account shows $37.64.

Available Balance is the amount of money that is in the account after all pending transactions have cleared; for example in the image below the account shows $32.64.

If you were to select the activity button (1), you can see that there is a hold for $5.00. Although you have $37.64 (Actual Balance); you only have $32.64 (Available Balance) [2] available to use.

- Do you offer Visa Gift Cards?

-

Yes, we currently offer Visa ® gift cards at all of our branch locations for a nominal fee.

- Is there a limit to how much money I can withdraw when using my debit card?

-

Yes, due to security reasons, we ask that you either go to a local branch or contact the Shamrock Center at 800-522-6611.

- How do I change my name on my account?

-

Due to security reasons, we ask that you either go to a local branch to fill out the appropriate forms or contact the Shamrock Center at 800-522-6611 and follow the prompts to contact an agent who will be able to assist you with this request.

- Can you explain how payments made to my credit card via online banking from my external account will work?

-

Contact us for a representative to help set up the external account for you. No forms are required and the service is free. Once the Notre Dame FCU representative sets this up, you will be able to make payments to your Notre Dame FCU credit card from an external account through online banking.

After you initiate a payment, you will see a transaction line for $0.00 on the date that you schedule the payment. Once the payment actually posts, you will see a new transaction line with the actual dollar amount. The funds must transfer from the external account first and then post to the credit card. This process can take 1-3 business days. Your payment will be dated for the date that the payment posts, NOT the date that you scheduled the payment.

- What Holidays are you closed for?

-

- New Year’s Day

- Martin Luther King Jr. Day

- Presidents’ Day

- Memorial Day

- Good Friday

- Juneteenth

- Independence Day

- Labor Day

- Columbus Day

- Veterans Day

- Thanksgiving Day

- Day after Thanksgiving

- Christmas Day

- Christmas Eve

- New Year’s Eve

- What fees do you charge?

-

A complete listing of our fees can be found in our Fee Schedule here.

Checking Your Balance

- How can I check my account balance?

-

We understand how important it is to have quick and easy access to your account balance. That’s why we offer two convenient options:

- Mobile App:

- Download our mobile app from the App Store or Google Play.

- Log in using your credentials.

- Navigate to the “Accounts” section to view your balance.

- Online Banking:

- Visit our website and click on the “Login” button.

- Enter your username and password.

- Go to the “Accounts” tab to see your current balance.

For those receiving Social Security deposits, please note that these are usually credited by the 3rd of each month. We encourage you to use our digital services to check your balance and confirm deposits to avoid any inconvenience.

Close Account

- How do I close my account?

-

To close your account, the credit union requires a written request which must include the following information:

• Your full name as it appears on the account

• Your NDFCU Member Account Number

• Your current address

• A “wet” signature; we cannot accept digital signaturesYou can send this request to us by:

• Walking into your local branch

• Mail a letter to: Notre Dame FCU PO Box 7878 Notre Dame, IN 46556-7878

• Send a fax to: 574-208-6000

• Send an email to: [email protected]

Stop Pay

- How can I do a stop payment on a check?

-

You can please a stop payment on a check, using online banking. Once you login, select My Account and then select Check Stop Payment. Once there, select the account from the drop down menu, enter the starting and ending check number to stop, and then select the Stop Payment button. Please note while we attempt to process the stop payment requests the same day, it can take up to three (3) business days to process.

- How long will it take to process a stop payment and how long will you keep it on file?

-

We will process a completed stop payment request the same business day it is received and it will remain on file for six (6) months. Please allow up to three (3) business days.

- Is there a stop payment fee?

-

There is a nominal fee to stop a payment on a check or ACH from your account. Please review our Truth in Savings disclosures for the most up to date fees.

Debit Card

- Can you explain how payments made to my credit card via online banking from my external account will work?

-

Contact us for a representative to help set up the external account for you. No forms are required and the service is free. Once the Notre Dame FCU representative sets this up, you will be able to make payments to your Notre Dame FCU credit card from an external account through online banking.

After you initiate a payment, you will see a transaction line for $0.00 on the date that you schedule the payment. Once the payment actually posts, you will see a new transaction line with the actual dollar amount. The funds must transfer from the external account first and then post to the credit card. This process can take 1-3 business days. Your payment will be dated for the date that the payment posts, NOT the date that you scheduled the payment.

- How do I activate my Visa Debit Card?

-

Please call the toll free number listed with your new Visa® card from the primary number we have on file. To activate a debit card for a person listed as a “secondary” on the account, you must use the “primary” member’s social security number to activate. Please note that each debit card must be activated separately.

- How do I add a travel alert for my credit or debit card?

-

Adding a travel alert is simple! Click this link to submit your travel notice to our card services team.

- How do I change my PIN on my Debit/Credit Card?

-

You can change your PIN at your local branch, phone banking, contacting the Shamrock Center or at an ATM.

Local Branch

Go to your local branch and a member service representative can assist you.

Phone Banking

Call 800.522.6611

Select Option 2 for phone banking

Select your language preference

Select option 4 to change your PIN

Follow the prompts to continue with the process until you have successfully changed your PIN.Shamrock Center

Call 800.522.6611

Follow the prompts to reach our service department

Answer verification questions to authenticate your identity

The representative will change your PINATM

Go to your local ATM

Put your card into the machine

Follow the screen prompts to change your PIN

- What do I do if I am a victim or suspect fraudulent activity on my card?

-

Please call the number on the back of the card, select option 3 for our Debit/credit card department and select option 2 to reach an agent. Please provide your information and the reason you believe there is fraudulent activity so that we can research and stop further activity.

- How to set up e-Alerts

-

To receive notifications about your card usage, simply set up eAlerts in online banking under the Member Services tab. For more details, watch the video below.

Card Valet

- I have My Location control turned on using the Card Valet app, had my phone in my pocket when I made a purchase at a gas station, but my transaction was still declined. Why?

-

In some cases, the merchant may process all of their card transactions in a central processing center which could be in a different city, state, and/or zip code. Since the city, state, and/or zip code shows a location outside the area where your phone is located, it will decline when the My Location Control Preference is turned On. This is common with purchases made at vending machines or kiosks where the central processing is often performed in a different location than where the terminal is physically located. If you click on the transaction summary in CardValet, the city and state where the processing is taking place is located under the merchant’s name.

- When I register, the Card Valet application says it sent a token to my registered email address. Which email will receive the token?

-

It will be sent to the Primary email address you have on file with Notre Dame FCU.

- Does the phone number entered to receive texts have to be my phone?

-

The CardValet app does not provide SMS based alerts. It only provides app notifications on the phone which has been selected as the primary device. In order to select the device as primary you must login to the app with your login credentials, click on settings, and set the primary device to “ON”

- I don't find ATMs close to my location though I know they exist?

-

Card Valet uses Google’s search engine for locating ATMs your search region. Sometimes, this search engine does not locate all the ATMs.

- I turned my card on but did not set any control preferences and my card was still declined. Why?

-

Card Valet allows you to control your card and set rules for where it cannot be used. However, even if a transaction is consistent with the usage policies that you have set, it may be declined for other reasons – for example the transaction triggered fraud rules or you do not have sufficient funds, etc. A transaction that fails your control rules will be declined, but a transaction that passes your control rules is still not always guaranteed to be approved.

- My card was blocked by the Notre Dame FCU fraud monitoring service due to a suspicious transaction. Why did I not receive an alert when the transaction occurred?

-

Our fraud monitoring service stopped the transaction from posting on the account when it detected the transaction may have been fraudulent. Since the transaction did not carry all the way through to our processing system, it did not trigger an Card Valet alert.

- Can multiple users register with Card Valet using the same account?

-

Only one user can register using a unique account number. Once you have registered using your account, you can add your dependent accounts using the “Add Account” feature in settings to control and monitor cards on all of your accounts where you are the primary account holder.

- If someone stole my phone, will they see my account information?

-

The Card Valet app doesn’t store any sensitive data so even if you lose your phone, no one will see your card or account numbers. Sensitive data is always masked in the app.

- I turned my card off using the Card Valet app. Can I check my balances at ATM?

-

Yes, recurring transactions that have already been set prior to turning the card off will continue to go through.

ATMs

- Can I make a deposit at a non-Notre Dame FCU ATM?

-

Yes, but please be aware that it may take longer for the funds to be available in your account. The time varies on the institution as they may place a hold on the funds.

Bill Pay

- Orange arrow I have questions about bill pay.

-

Any questions you have on Bill Pay can best be answered by contacting 866.266.6792.

- How can I make a payment to another financial institution?

-

You can transfer funds to another institution using our Bill Pay feature. To set BillPay log into online banking and select Pay Bills then select Enroll in Easy Pay.

You will now enter your email address and choose the primary account from which you will pay your bills. Select Next when you are ready to continue.

You will validate the information and select next.

You must review and accept to the terms and conditions (1) and then select Sign Me Up to enroll.

You will receive a notice that the bill pay requires you to log off and log back into the system.

When you log back in and select Pay Bills, your option now reads to Go to EasyPay. Select this button to continue with the process and you will select this option for future payments.

You will have to enter security questions, provide a security key and accept the terms and conditions. Once you have completed this, you can select the submit button to continue.

You are now offered the option to enter the information for your most recent payees. If you need assistance, you can use the Live Chat feature. If you do not have the information, you can go back to this page at a later date by selecting the Add a Payee and look for the image that read Show Me Popular Payees.

eStatements

- I would like to change my eStatement enrollment. How would I do this?

-

Once you enroll or opt out of estatements, you can change your mind any time. To change your estatement options, go to My Info and Select eStatement options.

You will read the eStatement terms and conditions and scroll to the bottom of the form.

Select your eStatement option, enter your email address and then select the Accept button.

- How do I enroll into eStatements?

-

Enrolling in eStatements lets you view your finances via your smartphone, tablet or computer. To enroll in eStatements, login to online banking. Once there, select Member Services and then select the Enroll button.

- How do I view my eStatements?

-

Once you enroll to receive eStatements, you will receive a monthly email notifying you that your eStatement is available to view. To view your eStatements, login to the online banking platform. Select My Documents and then select Go to eStatements.

Open Accounts

- How do I open a Christmas Club or Special Savings Account?

-

Select “Open” next to the account and you will have an option to verify your account choice (1); enter the amount you wish to deposit (2); transfer the money from your current account (3); and select the Open Account button(4). Once you select Open Account (4), you will see the account on your main page.

Please note that the rates may vary and that the accounts may have a minimum balance requirement which must be met in order to receive dividends. Once you open the account, you will see it on your main log in page.

Remote Deposit Capture

- What is Remote Deposit Capture (RDC)?

-

With Remote Deposit Capture you can deposit checks from your mobile device with the ease of taking a picture. Remote Deposit is:

- Easy- Select deposit. Photograph your check. Verify and select the “Submit” button.

- Convenient- 24/7 access. Deposit checks on your own schedule. Skip the trip, lines and even ATMs.

- Fast- Download the Notre Dame FCU mobile banking app to get started. You’ll recceive in-app confirmation that your images have successfully uploaded and your check is being processed.

- If I use both Online Banking and your Mobile Banking app, will I see my transaction history reflected in both places?

-

Yes. The transaction description will appear as “Remote Deposit”

- Is there a check limit for Remote Deposit Capture?

-

We do have a limit of $2,500.00 when depositing checks via RDC.

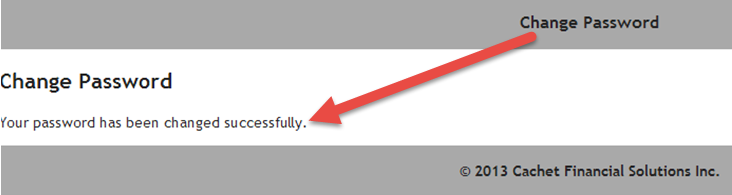

- How can I reset my RDC password?

-

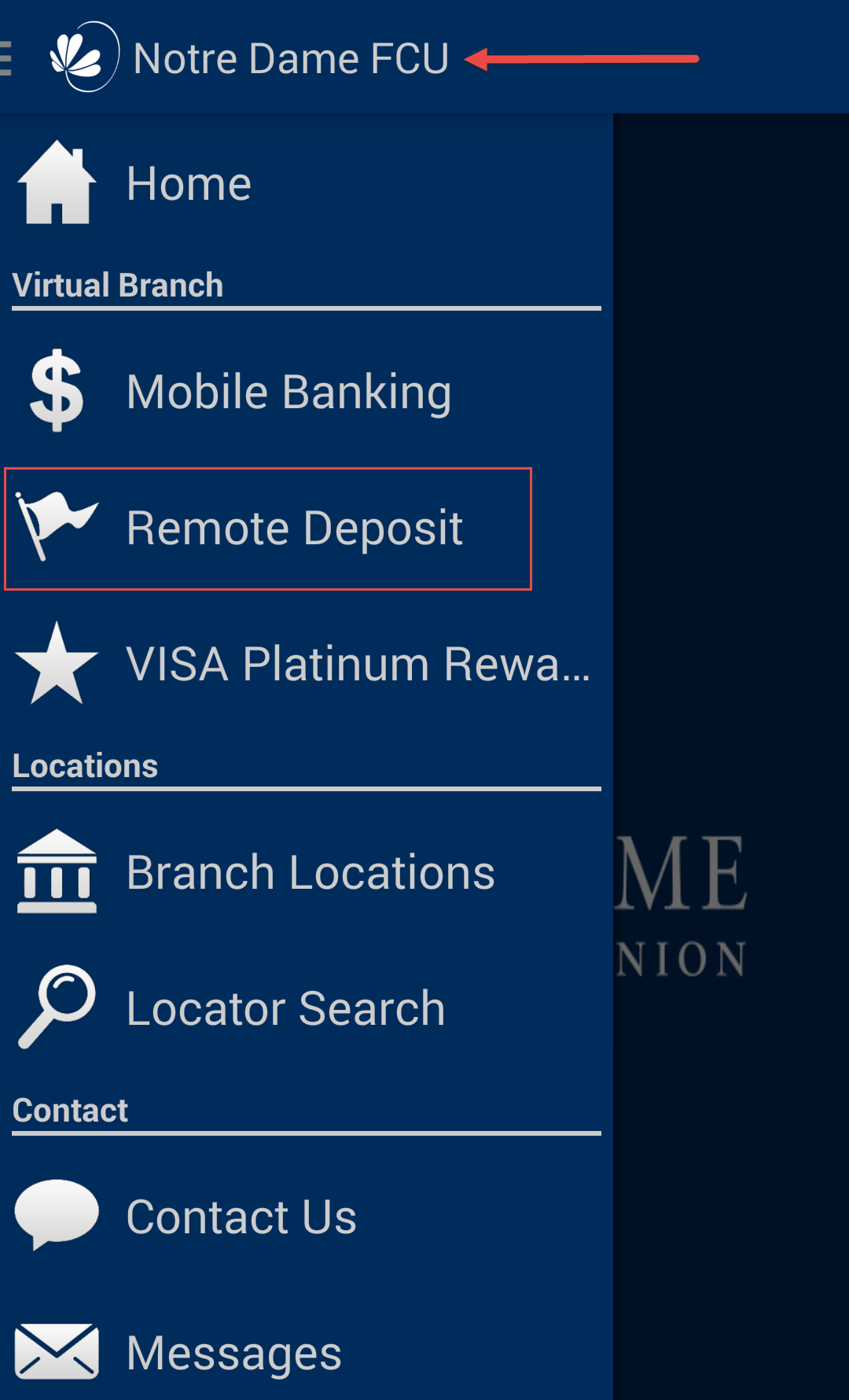

Go to your Notre Dame FCU mobile app and select the Remote Deposit Capture link from the menu.

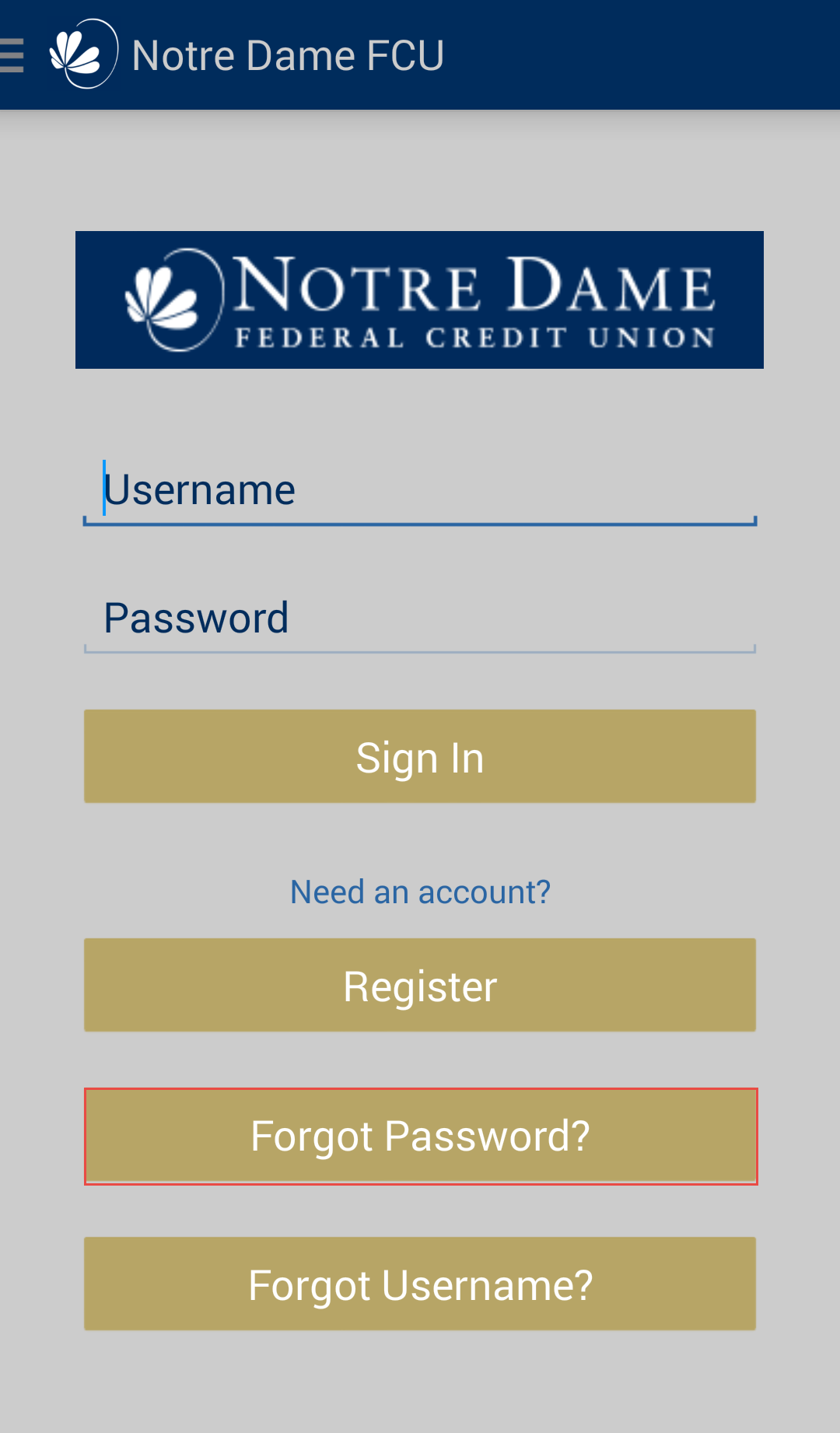

Select the “forgot password” link to reset your password.

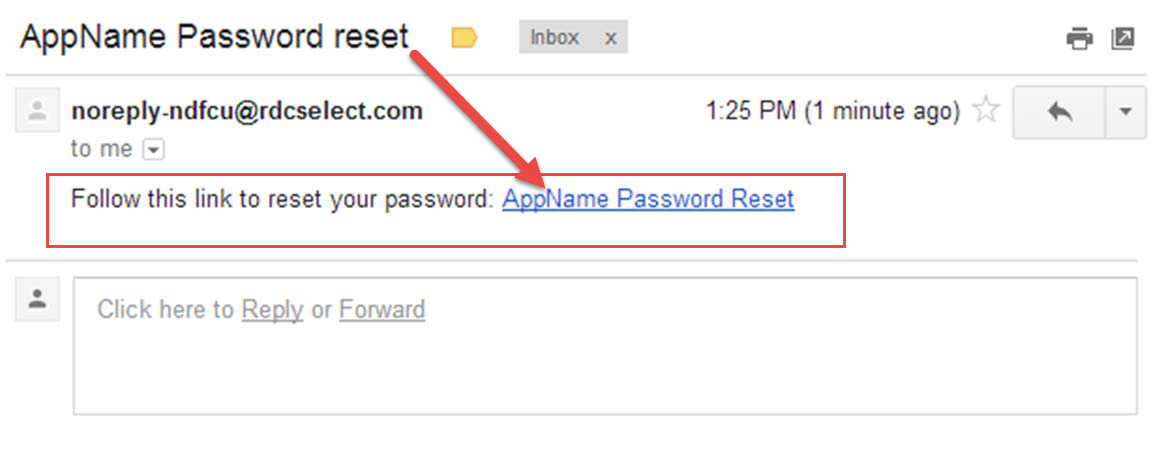

You will receive an email; follow the link to reset the password.

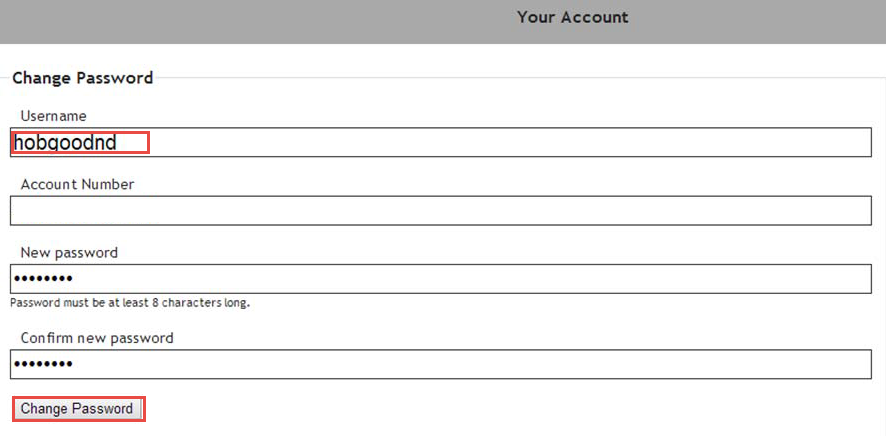

Enter your username, account number with suffix, and new password.

You will then receive a message confirming the password has been changed.

My Virtual Strongbox

- What is My Virtual Strongbox?

-

My Virtual Strongbox is a digital storage space provided to you as a member of Notre Dame FCU.

- How much does it cost to have and use My Virtual Strongbox?

-

Notre Dame FCU provides 50 MB of storage at no cost to you.

- How much space do I have in My Virtual Strongbox?

-

All of our members receive 50 MB of storage to use as they deem appropriate.

- I need more than 50MB of space. Can I request more?

-

You can purchase as much space as you need inside My Virtual Strongbox. You will be billed according to the terms and conditions at the time of purchase.

ND MoneyWorks

- What is ND MoneyWorks?

-

ND MoneyWorks is a personal financial management service that combines, organizes and tracks all of your financial information. With it, you can track expenses, create budgets, set goals and plan for the future.

- Do I already need to have online accounts before using ND MoneyWorks?

-

Yes, you need to set up online accounts with any financial institution you want to access using ND MoneyWorks. The system imports data from your online accounts. Once set up, you will not need to make changes unless you change your passwords.

- How long does it take to use ND MoneyWorks the first time?

-

First-time users usually take 20-25 minutes to fully complete the process. But, this can be done over time if you wish – ND MoneyWorks saves your information so when you log back in, you can pick up where you left off!

- Is there a mobile app for ND MoneyWorks?

-

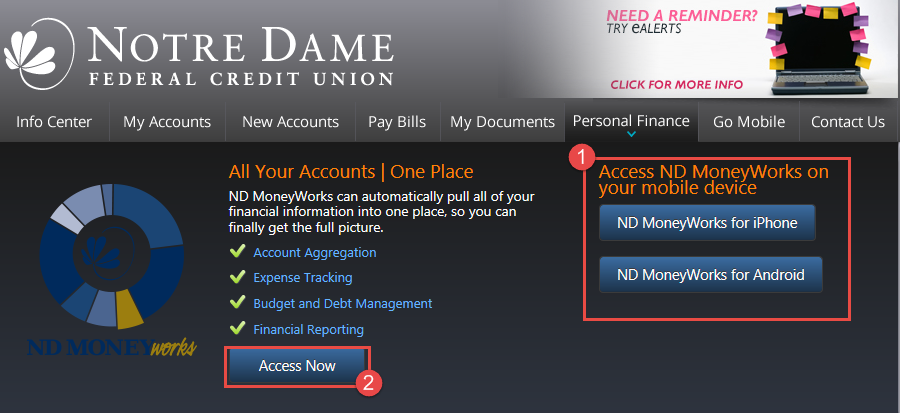

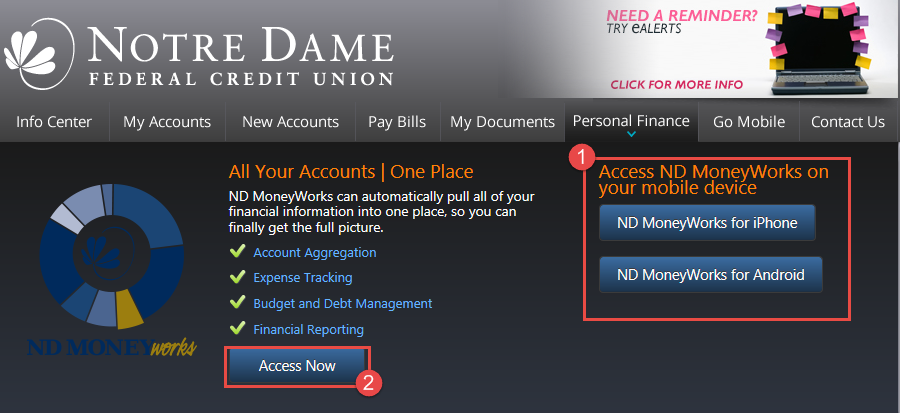

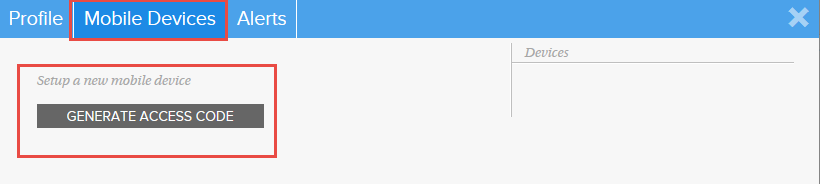

A ND MoneyWorks app is available for use on Android and Apple devices. Refer to the MoneyWorks Mobile page under Your Services for instructions on how to activate your mobile account and download the app (1).

- How does ND MoneyWorks get my account information?

-

ND MoneyWorks connects to Notre Dame FCU and other institutions through secure connections by using your user ID and password for each institution to collect your financial data. This is how it provides real time updates and helps you manage your finances on the go.

- Why does ND MoneyWorks require an active email address?

-

ND MoneyWorks uses your email address as your unique user ID to verify your account during sign-up, to send alerts and for occasional communications from Notre Dame FCU.

- How can I start using ND MoneyWorks?

-

Your account comes with our ND MoneyWorks desktop application as well as the free mobile app available. You can take advantage of this by following the steps below:

1) Become a member of Notre Dame FCU

2) Sign up for ND MoneyWorks by logging in to online banking and selecting the personal finance tab.

3) Download the app- (1) once installed, please proceed to Step 4 before launching.

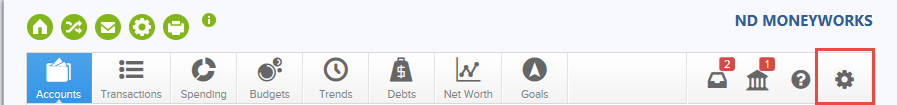

4) Access ND MoneyWorks (2) and Activate ND MoneyWorks for Mobile by signing into online banking and select the settings icon.

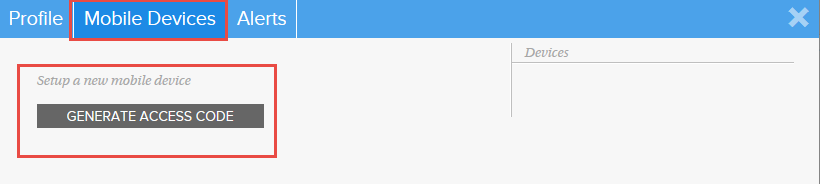

5) Select Mobile Devices and Select “Generate Access Code”.

Enter the code into the downloaded app.

6) Questions? Review the FAQ’s or contact us for assistance.

- What personal finance software is compatible with my Notre Dame FCU account?

-

We recommend using NDMoneyWorks, powered by MoneyDesktop. ND MoneyWorks is integrated into online banking and empowers you to take control of your finances, simplifying your life.

- I am still not comfortable with using ND MoneyWorks, do you have other training available?

-

Once you login to the application, you will find built-in tutorials, videos and a knowledge bank to help you set up and manage your accounts.

- Is ND MoneyWorks secure?

-

Yes, using ND MoneyWorks is very safe. Protecting our members’ data is vital at Notre Dame FCU. We, and our partners use the latest technology to ensure your accounts are safe and secure. All data is transmitted over SSL with a VeriSign Class 3 Extended Validation SSL Certificate.

- I received a notification email from MoneyDesktop. Is this legitimate?

-

Yes. Notre Dame FCU has partnered with MoneyDesktop to bring you ND MoneyWorks. Some email notifications from ND MoneyWorks will originate from Money Desktop.

- How can I access ND MoneyWorks?

-

ND MoneyWorks can be accessed through Notre Dame FCU online banking (2) or through the MoneyWorks Mobile App (3).

- How long will it take to get an answer to my ND MoneyWorks question?

-

The support team tries to respond to every inquiry as quickly as possible, typically within a few hours. However, responses may take up to 1 business day if you are contacting us outside of the standard business hours.

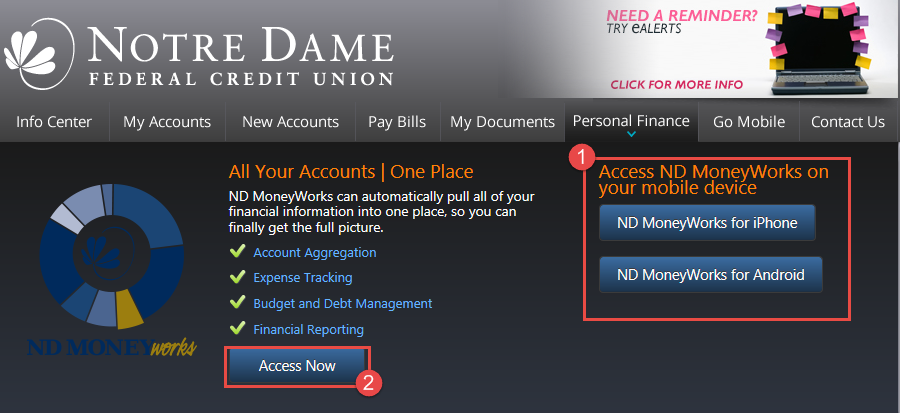

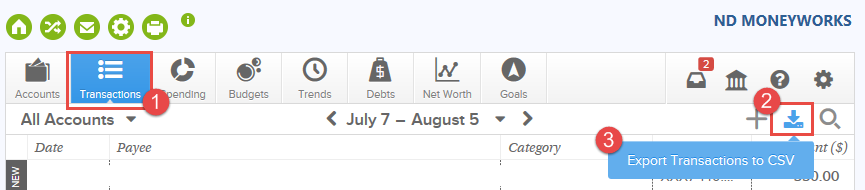

- Can I export data from ND MoneyWorks?

-

Yes! In the desktop version, you can export from the Transactions tool (1) by selecting the export option (2) and select “Export CSV” (3).

- Who can use ND MoneyWorks?

-

ND MoneyWorks is a free service offered to Notre Dame FCU members. If you are not a member, and would like to see if you are eligible to become one, please call us at 800-522-6611. Follow the prompts to speak to one of our Shamrock Center Agents.

- What if I need help with ND MoneyWorks?

-

ND MoneyWorks includes built-in tutorials, videos and a knowledge bank that helps you answer the most common questions. But, we understand sometimes you may encounter a more specific issue that requires individual attention. Within ND MoneyWorks, an online support team can be reached through the “?” icon located in upper right hand corner of ND MoneyWorks. If you still need assistance you can call Notre Dame FCU for assistance at 800-522-6611.

- Do existing MoneyWorks mobile users need to create an access code?

-

No. Access codes are only intended for new mobile customers or when setting up a new mobile device to your account.

If you are an existing MoneyWorks Mobile user that has been able to login to the application, no action is required.

- How can ND MoneyWorks help me?

-

ND MoneyWorks helps you get a clear picture of your finances by combining all your financial information in one place. It goes further by helping you establish and track budgets, create goals and plan for your future. The information is updated automatically and can be linked to external accounts such as credit cards, auto loans and mortgage services.

- Is there a fee to use ND MoneyWorks?

-

No. ND MoneyWorks is a free service offered to Notre Dame FCU members.

Fee Schedule

- What fees do we charge?

-

A complete listing of our fees can be found in our Fee Schedule here.

Loans

- How do I make a loan or credit card payment from an external financial institution to NDFCU?

-

You will need to set up an Account – to – Account transfer. At this time only payments from a checking account, using a check’s routing and account number, are available to make Account – to – Account payments. Please contact your local branch or the Shamrock Center for assistance.

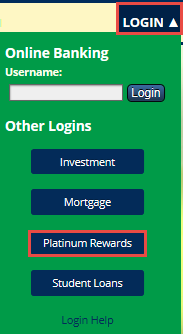

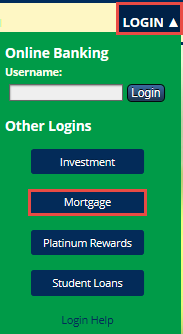

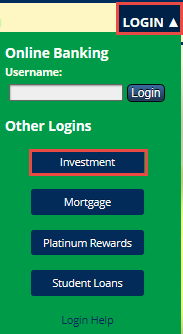

- How do I login to see my mortgage information?

-

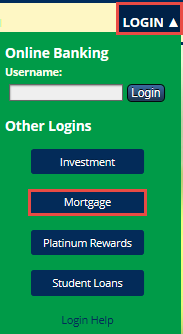

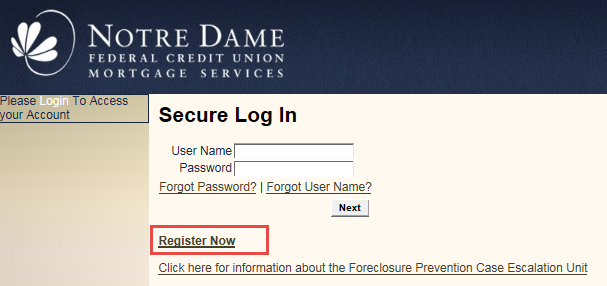

You will select the login button from our home page and select the Mortgage button from the menu.

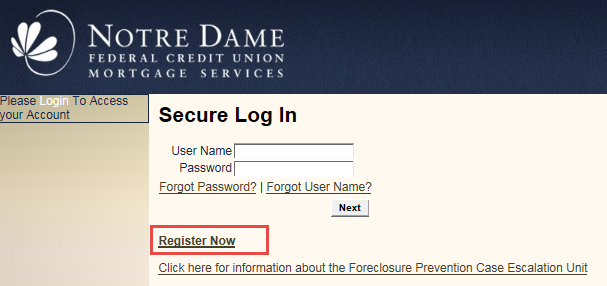

First Time Users

If you are a first time user, select the Register Now link.

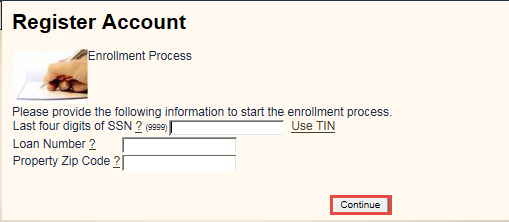

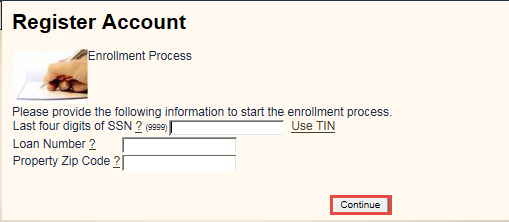

Enter the last 4 digits of your Social Security Number, Loan Number located on your mortgage statement, and the zip code of the property. Select Continue to create a username and password.

Follow the screen prompts to create your account and view your mortgage information.

Returning users

Follow the instructions in “I have questions on an existing mortgage. Who can help me?“

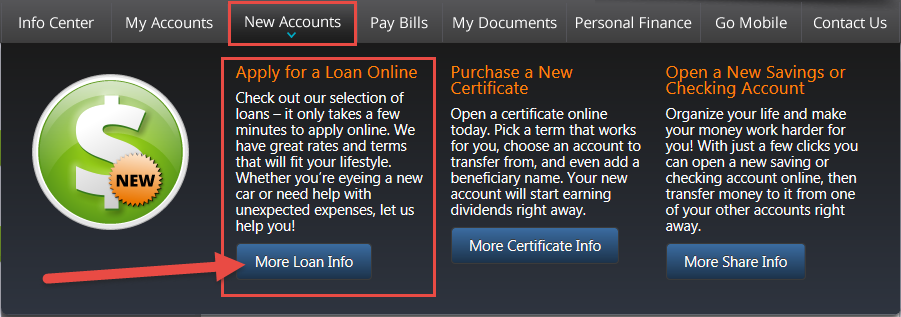

- How do I apply for a loan?

-

Non-Members: You can begin the application process online via the home page, go to a local branch, or call the Shamrock Center to apply for a loan.

Existing Members: You can begin the application process online via the home page, go to a local branch, call the Shamrock Center, or login to online banking. Once logged in, select New Accounts and select the More Loan Information button.

Once there, select the loan product you wish to apply for (1) and select the apply online link (2) to complete the application. Please note the image below is used as an example; rates may change and you should refer to the actual loan page for the most current rates.

Once you begin an application or complete the application, it is added to our system and a lending officer will contact you within 1 business day.

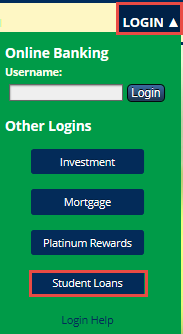

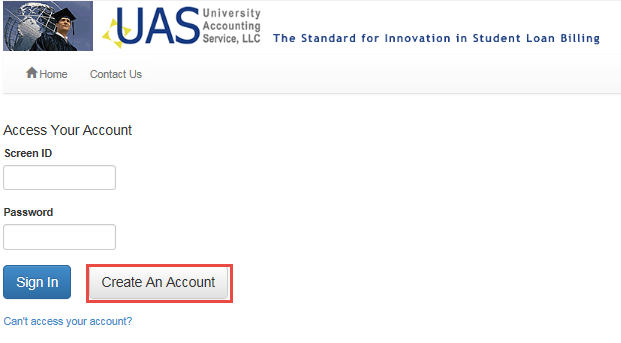

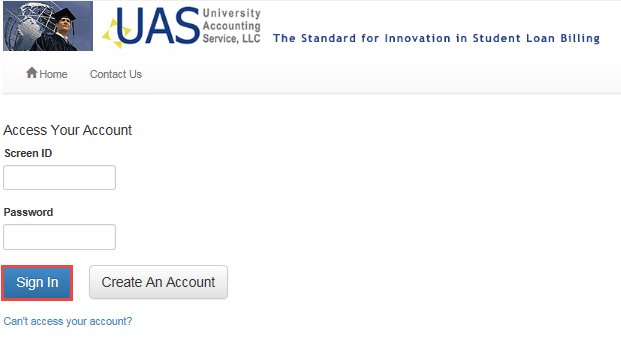

- How do I log into my student loans account?

-

From the home page, select the login button and choose the Student Loans button from the menu.

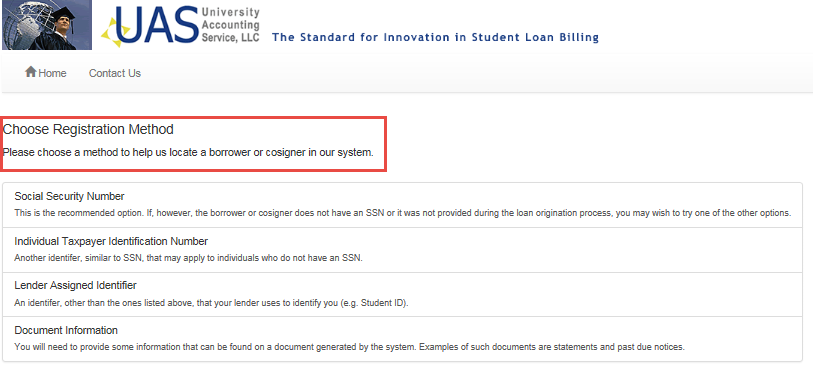

First Time Users:

If you are a first time user, select Create an Account to continue.

Select the registration method and follow the online screen prompts.

Returning Users:

Enter you screen ID and password, then select Sign In to view your account.

Credit Card

- Can you explain how payments made to my credit card via online banking from my external account will work?

-

Contact us for a representative to help set up the external account for you. No forms are required and the service is free. Once the Notre Dame FCU representative sets this up, you will be able to make payments to your Notre Dame FCU credit card from an external account through online banking.

After you initiate a payment, you will see a transaction line for $0.00 on the date that you schedule the payment. Once the payment actually posts, you will see a new transaction line with the actual dollar amount. The funds must transfer from the external account first and then post to the credit card. This process can take 1-3 business days. Your payment will be dated for the date that the payment posts, NOT the date that you scheduled the payment.

- How do I change my PIN on my Credit Card?

-

You can change your PIN at your local branch, phone banking, contacting the Shamrock Center or at an ATM.

Local Branch

- Go to your local branch and a member service representative can assist you.

Phone Banking

- Call 800.522.6611

- Select Option 2 for phone banking

- Select your language preference

- Select option 4 to change your PIN

- Follow the prompts to continue with the process until you have successfully changed your PIN.

Shamrock Center

- Call 800.522.6611

- Follow the prompts to reach our service department

- Answer verification questions to authenticate your identity

- The representative will change your PIN

ATM

- Go to your local ATM

- Put your card into the machine

- Follow the screen prompts to change your PIN

- What do I do if I am a victim or suspect fraudulent activity on my card?

-

Please call the number on the back of the card, select option 3 for our Debit/credit card department and select option 2 to reach an agent. Please provide your information and the reason you believe there is fraudulent activity so that we can research and stop further activity.

- Orange arrow How do I report my credit or debit card lost or stolen?

-

Please contact Notre Dame FCU immediately if your credit card or debit card is lost or stolen. Please contact us at 800-522-6611 and select option 3 for debit and credit card inquiries.

- Why is my card being declined?

-

To better assist you, please call the number on the back of your card. You will be prompted to select an option from the IVR, select option 3 and then select option 2. A representative can research your card and provide information as to why it was declined.

- How can I activate my PIN on my credit card?

-

You can activate your PIN at your local branch, phone banking or contacting Shamrock Center.

Local Branch

- Go to your local branch and a member service representative can assist you.

Phone Banking Activation

- Call 800-522-6611

- Select option 2 for phone banking

- Select your language preference

- Follow the prompts to continue with the activation process.

Shamrock Center Activation

- Call 800.522.6611

- Follow the prompts to reach our service department

- Answer verification questions to authenticate your identity

- The representative will activate your PIN

- Can I use my Notre Dame FCU credit card internationally?

-

Yes! Both your debit and your credit card can be used anywhere Visa® is accepted. Keep in mind that a fee will be imposed on all foreign transactions, including purchases, cash withdrawals, cash advances, and credits to your account. A foreign transaction is any transaction that you complete or a merchant completes on your card outside the United States, Puerto Rico or the U.S. Virgin Islands.

There is a nominal fee for international use: debit cards 1% and credit cards are 2%.

NOTE: Please keep in mind that all cards are blocked in all countries on the Office of Foreign Assets Control (OFAC) list. We also have our debit cards blocked in Spain, Pakistan, Russia, Romania, Ukraine, and Nigeria. Our credit cards are blocked in Brazil, Turkey, Russia, Mali, Ukraine, and Nigeria. Should you be traveling to any of these other countries (not on the OFAC list), we can allow a limited number of daily purchases during your visit with a two-day advance notice.

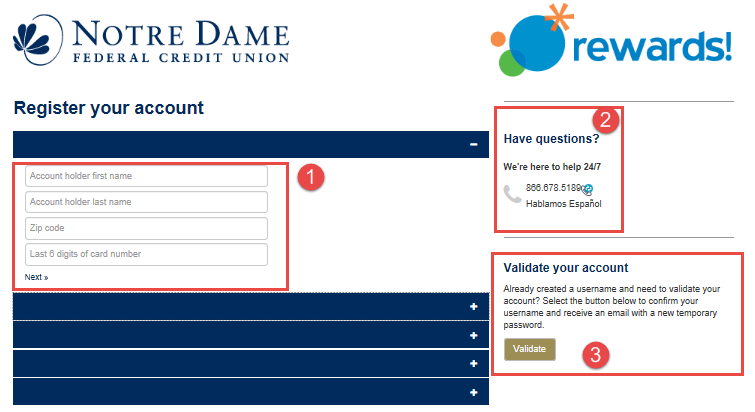

Platinum Rewards

- How do I log in to my Platinum Rewards account?

-

You must have a Visa Platinum card with NDFCU to receive the platinum rewards benefit. If you have a Platinum Credit Card, select Login and then select Platinum Rewards from the menu.

First Time Users

Please select the Register button to create your Rewards account.

You will need to enter the account holder’s information, zip code and last 6 digits of the card number (1). If you have questions, contact customer service (2). If you already have a username but need to validate your account, select the validate button (3).

Returning Users:

If you have completed the registration process, enter your user name and select Sign In to view your account or redeem your points.

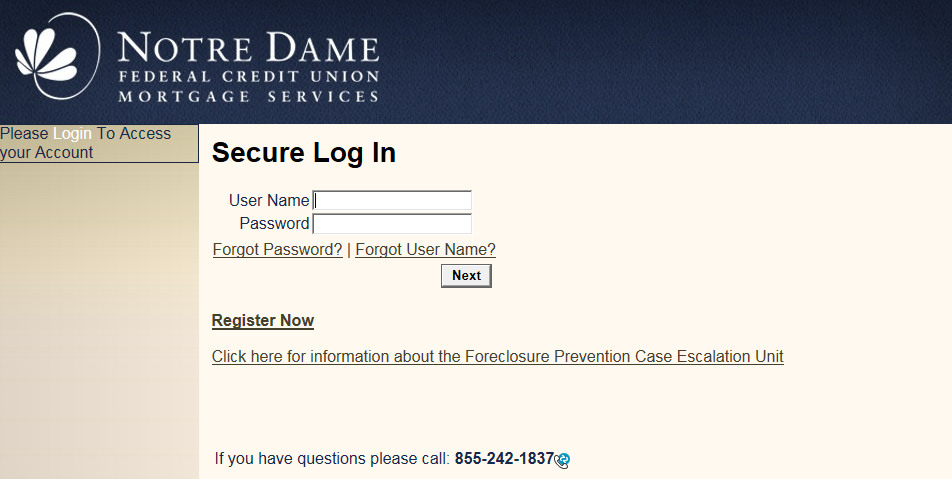

Mortgage

- I have questions on an existing mortgage. Who can help me?

-

If you have questions in regards to an existing mortgage, please call 855-242-1837. You can also login to your online mortgage portal .

- How do I login to see my mortgage information?

-

You will select the login button from our home page and select the Mortgage button from the menu.

First Time Users

If you are a first time user, select the Register Now link.

Enter the last 4 digits of your Social Security Number, Loan Number located on your mortgage statement, and the zip code of the property. Select Continue to create a username and password.

Follow the screen prompts to create your account and view your mortgage information.

Returning users

Follow the instructions in “I have questions on an existing mortgage. Who can help me?“

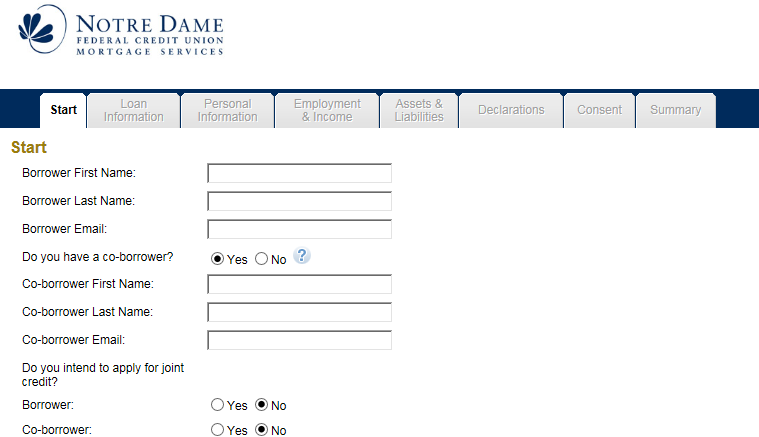

- I would like to purchase a home. How do I qualify or where do I go to get information on a new mortgage?

-

We understand that purchasing a new home is a very exciting time for you and we want to make the process as easy as possible for you. We have several ways to help you during this exciting time. You can visit our website to view the rates (1) and apply (2) to any of our available mortgage products (3).

When you are ready to apply for a mortgage, you can do this online or over the phone at 844.634.6631 and select option 2. If you elect to do the application online, enter all of the requested information so that we can provide you with a decision as soon as possible.

Feel free to contact us at:

Notre Dame FCU

PO Box 7878

Notre Dame, IN 46556

Toll Free: 844.634.6631Email: [email protected]

Investments

- How do I log in to my Investment Account?

-

From the home page, select login and then choose Investment from the menu.

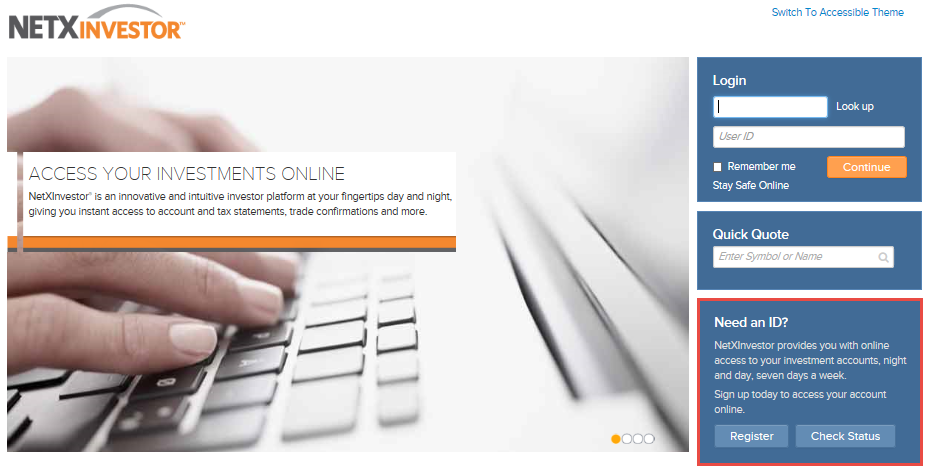

First Time Users

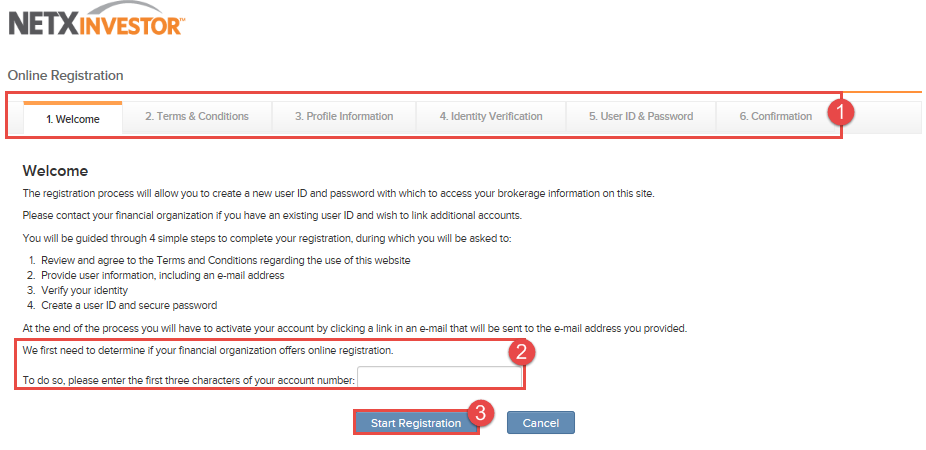

From the main page, go to the Need ID box and select Register.

You will go through the 6 step process (1) after you enter your account information (2) and then select Start Registration (3). Follow the steps to complete the registration process.

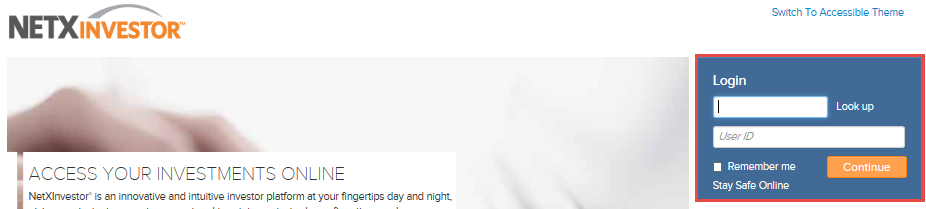

Returning Users:

If you have completed the registration process, you will log in using your user id and select Continue to access your account.

Charitable Giving

- How to Apply for a Charitable Gift or Sponsorship from Notre Dame FCU

-

You will need to send a letter or email to Stephanie Schrock at [email protected] or PO Box 7878, Notre Dame, IN 46556.

The letter or email should include the following information:

- The amount requested

- The purpose of the gift

- The organization’s name and contact information (address, phone number, and email address)

- The name of a contact person from the organization

- A brief description of the organization’s purpose, history, and goals

- Notification as to whether or not the organization or its principals are members of Notre Dame FCU.

Gift requests are reviewed on a monthly basis and should be submitted at least six weeks prior to the fundraising deadline. If approved, gift recipients will be notified by phone, mail, or email (please do not call).