What You Need to Know About Overdrafts and Overdraft Fees

An overdraft occurs when the available balance in your account is insufficient to cover a transaction, but we pay it anyway. We can cover your overdraft in two ways:

- We have standard overdraft practices that come with most checking accounts.

- We also offer overdraft protection plans, such as a link to a savings account or a link to a line of credit to cover overdrafts, which may be less expensive than our standard overdraft practices. To learn more, ask us about these plans.

What are the standard overdraft practices that come with my account?

We do authorize and pay overdrafts up to a preset amount for the following types of transactions:

- Checks and other transactions made using your checking account number

- Automatic bill payments

We DO NOT authorize and pay overdrafts for the following types of transactions, unless you ask us to do so:

- ATM transactions

- Everyday debit card transactions

We pay overdrafts at our discretion, which means that we do not guarantee that we will always authorize and pay any type of transaction. If we do not authorize and pay an overdraft, your transaction will be declined.

What fees will I be charged if Notre Dame Federal Credit Union pays my overdraft?

Under our standard overdraft practices:

- We will charge you a fee of $12 each time we pay an overdraft.

- There is no limit on the total fees we can charge you for overdrawing your account.

What if I want Notre Dame Federal Credit Union to authorize and pay overdrafts on my ATM and everyday debit card transactions?

If you want us to authorize and pay overdrafts on ATM and everyday debit card transactions, simple complete the form below and drop it off in-person or mail it to PO Box 7878, Notre Dame, IN 46556, complete the form online or call 800-522-6611.

Additional Information on Overdrafts and Your Available Balance

What if I want to revoke authorization to pay overdrafts on my ATM and everyday debit card transactions?

You reserve the right to revoke the payment of overdrafts for ATM and everyday debit card transactions at any time by contacting us either in person, by mail (PO Box 7878, Notre Dame, IN 46556) or by phone (800-522-6611).

Under federal law, members of Notre Dame Federal Credit Union decide whether or not to “opt-in” for Overdraft Protection Coverage. If you do not choose to opt-in, we will not authorize and pay overdrafts for ATM and everyday debit card transactions you make at a store, online or by telephone, and therefore, the transactions will be declined if they exceed your available balance. If you opt-in, you are allowing us to pay items presented against your share draft account, even if they exceed your available balance.

We use the available balance in your account to determine whether your account has sufficient available funds to pay a transaction or item and for determining whether a transaction or item will incur an overdraft fee or NSF fee.

How do we determine your account’s available balance?

We use the “available balance” method to determine whether your account is overdrawn, that is, whether there are sufficient available funds in your account to pay for a transaction. Importantly, your “available” balance may not be the same as your account’s actual balance. This means an overdraft, or an NSF transaction could occur regardless of your account’s actual balance.

As the name implies, your available balance is calculated based on the money “available” in your account to make payments. In other words, the available balance takes transactions that have been authorized, but not yet settled, and subtracts them from the actual balance. In addition, when calculating your available balance, any “holds” placed on deposits that have not yet cleared are also subtracted from the actual balance.

Your account’s actual balance only includes transactions that have settled up to that point in time, that is, transactions (deposits and payments) that have posted to your account. The available balance does not reflect every transaction you have initiated or we previously authorized. For example, your available balance may not include the following:

- Outstanding checks and authorized withdrawals (such as recurring debit card transactions and ACH transactions that we have not received for payment)

- The final amount of a debit card purchase. For example, we may authorize a purchase amount prior to a tip that you add.

- Debit card transactions that have been previously authorized but not sent to us for final payment.

The balance on your periodic statement is the actual balance for your account as of the statement date.

How can I find information on my available balance as compared to my actual balance?

Keeping track of your balance is important. You can review your balance in a number of ways including reviewing your periodic statement, reviewing your balance online, accessing your account information by phone, or coming into one of our branches.

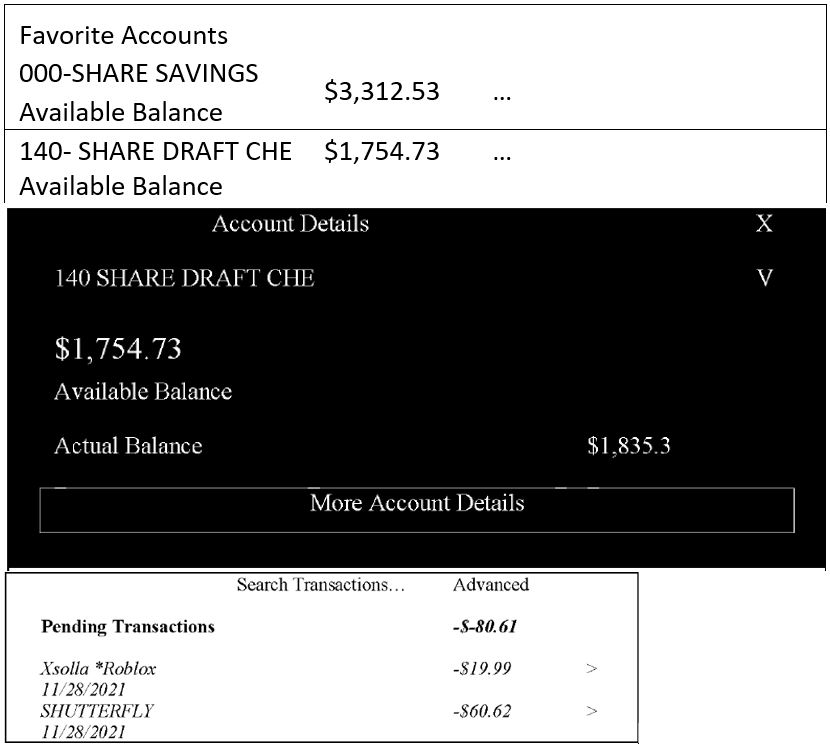

Your available balance and actual balance are identified in the Notre Dame FCU mobile app as appears in the sample below. When you select account details you will be presented with your available balance and your actual balance. If there is a difference between your available and actual balance, you can view debit card transactions that have not settled under pending transactions.

EXAMPLE:

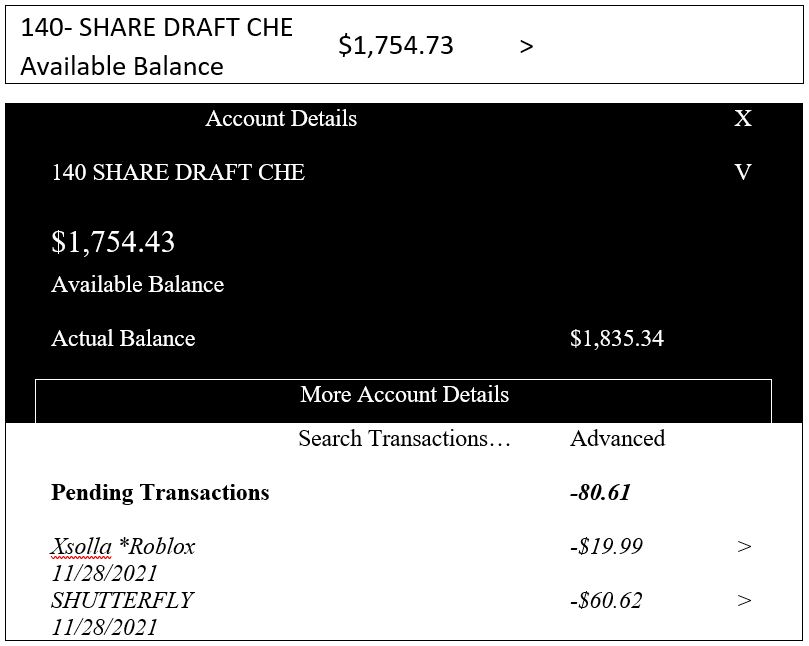

Your available balance and actual balance are identified in online banking as it appears in the example below. When you select account details you will be presented with your available balance and your actual balance. If there is a difference between your available and actual balance, you can view debit card transactions that have not settled under pending transactions.

EXAMPLE: