Lo que necesita saber sobre los sobregiros y las comisiones por sobregiro

Un sobregiro ocurre cuando el saldo disponible en su cuenta es insuficiente para cubrir una transacción, pero la pagamos de todos modos. Podemos cubrir tu sobregiro de dos maneras:

- Tenemos prácticas de sobregiro estándar que vienen con la mayoría de las cuentas corrientes.

- También ofrecemos planes de protección contra sobregiros, como un vínculo a una cuenta de ahorros o un vínculo a una línea de crédito para cubrir sobregiros, que pueden ser menos costosos que nuestras prácticas estándar de sobregiros. Para saber más, pregúntanos sobre estos planes.

¿Cuáles son las prácticas de sobregiro estándar que vienen con mi cuenta?

Autorizamos y pagamos sobregiros hasta un monto preestablecido para los siguientes tipos de transacciones:

- Cheques y otras transacciones realizadas utilizando su número de cuenta corriente

- Pagos automáticos de facturas

NO autorizamos ni pagamos sobregiros para los siguientes tipos de transacciones, a menos que usted nos lo solicite:

- Transacciones en cajeros automáticos

- Transacciones diarias con tarjeta de débito

Pagamos sobregiros a nuestra discreción, lo que significa que no garantizamos que siempre autorizaremos y pagaremos cualquier tipo de transacción. Si no autorizamos y pagamos un sobregiro, su transacción será rechazada.

¿Qué tarifas se me cobrarán si? Notre Dame Federal Credit Union ¿Paga mi sobregiro?

Según nuestras prácticas de sobregiro estándar:

- Le cobraremos una tarifa de $12 cada vez que paguemos un sobregiro.

- No hay límite en las tarifas totales que podemos cobrarle por sobregirar su cuenta.

¿Y si quiero? Notre Dame Federal Credit Union ¿Cómo autorizar y pagar sobregiros en mis transacciones diarias con cajeros automáticos y tarjetas de débito?

Si desea que autoricemos y paguemos sobregiros en transacciones con cajeros automáticos y tarjetas de débito diarias, simplemente complete el formulario a continuación y entréguelo en persona o envíelo por correo a PO Box 7878, Notre Dame, IN 46556, complete el formulario en línea o llame al 800-522-6611.

Información adicional sobre sobregiros y su saldo disponible

¿Qué pasa si quiero revocar la autorización para pagar sobregiros en mis transacciones diarias con cajeros automáticos y tarjetas de débito?

Usted se reserva el derecho de revocar el pago de sobregiros por transacciones en cajeros automáticos y tarjetas de débito diarias en cualquier momento comunicándose con nosotros en persona, por correo (PO Box 7878, Notre Dame, IN 46556) o por teléfono (800-522-6611).

Según la ley federal, los miembros de Notre Dame Federal Credit Union Decida si desea o no la Cobertura de Protección contra Sobregiros. Si no la acepta, no autorizaremos ni pagaremos sobregiros por transacciones en cajeros automáticos ni con tarjeta de débito que realice en tiendas, en línea o por teléfono. Por lo tanto, las transacciones serán rechazadas si exceden su saldo disponible. Si la acepta, nos permite pagar los sobregiros de su cuenta de cheques, incluso si exceden su saldo disponible.

Utilizamos el saldo disponible en su cuenta para determinar si su cuenta tiene fondos suficientes disponibles para pagar una transacción o un artículo y para determinar si una transacción o un artículo generará un cargo por sobregiro o un cargo por fondos insuficientes.

¿Cómo determinamos el saldo disponible de su cuenta?

Utilizamos el método de "saldo disponible" para determinar si su cuenta está sobregirada, es decir, si dispone de fondos suficientes para realizar una transacción. Es importante destacar que su saldo "disponible" puede no coincidir con el saldo real de su cuenta. Esto significa que podría producirse un sobregiro o una transacción sin fondos (NSF) independientemente del saldo real de su cuenta.

Como su nombre lo indica, su saldo disponible se calcula con base en el dinero disponible en su cuenta para realizar pagos. En otras palabras, el saldo disponible toma las transacciones autorizadas, pero aún no liquidadas, y las resta del saldo real. Además, al calcular su saldo disponible, cualquier retención sobre los depósitos que aún no se hayan liquidado también se resta del saldo real.

El saldo real de su cuenta solo incluye las transacciones liquidadas hasta ese momento, es decir, las transacciones (depósitos y pagos) registradas en su cuenta. El saldo disponible no refleja todas las transacciones que usted ha iniciado o que hemos autorizado previamente. Por ejemplo, su saldo disponible podría no incluir lo siguiente:

- Cheques pendientes y retiros autorizados (como transacciones recurrentes con tarjeta de débito y transacciones ACH que no hemos recibido para su pago)

- El monto final de una compra con tarjeta de débito. Por ejemplo, podemos autorizar un monto de compra antes de agregar una propina.

- Transacciones con tarjeta de débito que han sido autorizadas previamente pero que no nos han sido enviadas para el pago final.

El saldo de su estado de cuenta periódico es el saldo real de su cuenta a la fecha del estado de cuenta.

¿Cómo puedo encontrar información sobre mi saldo disponible en comparación con mi saldo real?

Es importante llevar un registro de su saldo. Puede consultarlo de diversas maneras, como consultar su estado de cuenta periódico, consultar su saldo en línea, acceder a la información de su cuenta por teléfono o visitar una de nuestras sucursales.

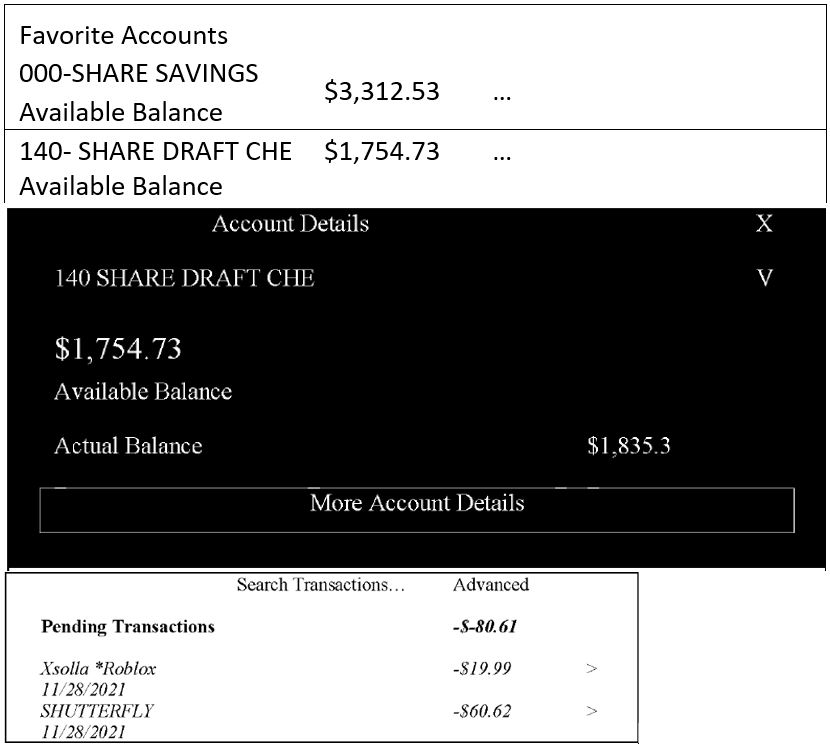

Su saldo disponible y saldo real se identifican en el Notre Dame FCU Aplicación móvil, como se muestra en el ejemplo a continuación. Al seleccionar los detalles de la cuenta, se mostrarán el saldo disponible y el saldo real. Si hay una diferencia entre el saldo disponible y el real, puede ver las transacciones con tarjeta de débito pendientes en la sección de transacciones pendientes.

EJEMPLO:

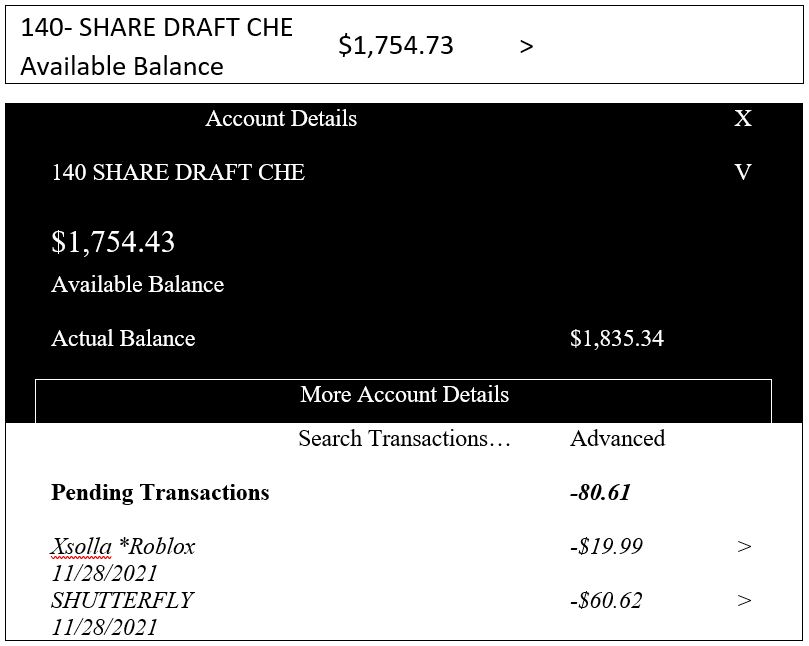

Su saldo disponible y su saldo real se identifican en la banca en línea, como se muestra en el ejemplo a continuación. Al seleccionar los detalles de la cuenta, se mostrarán ambos saldos. Si hay una diferencia entre ambos, puede ver las transacciones con tarjeta de débito pendientes en la sección de transacciones pendientes.

EJEMPLO: